In the race against climate change, the development of robust Carbon Credit Markets has been pivotal in steering global efforts towards a sustainable future. Carbon Credit Markets, established under these frameworks, are critical tools that allow entities to trade carbon credits, effectively incentivizing the reduction of carbon emissions. Swiss Trust Trading Group (STTG) has been at the forefront of leveraging these Carbon Credit Markets to foster significant environmental and economic benefits through strategic partnerships and conservation initiatives, particularly in areas like the Gran Chaco forest.

The Evolving Carbon Markets Landscape

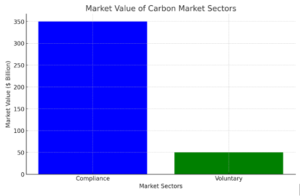

Carbon Credit Markets function within a framework where emissions caps are set, and carbon credits are traded. These Carbon Credit Markets are divided into compliance and voluntary sectors, each governed by specific regulatory standards aimed at ensuring the integrity and effectiveness of the carbon credits. According to the World Bank’s concept paper on carbon market linkage, the rigor of these frameworks and their ability to interlink various regional markets under a unified global standard are critical for their success.

STTG’s Strategic Engagement in Carbon Credit Markets

STTG plays a pivotal role in shaping carbon credit markets through strategic environmental investments aimed at combating deforestation. The Gran Chaco forest, one of the world’s most endangered ecosystems, serves as a central focus of STTG’s sustainability efforts. By collaborating with companies dedicated to sustainable investments, STTG supports transforming vast stretches of this threatened forest into protected conservation areas designed to maximize carbon sequestration.

Ensuring High-Quality Carbon Credits through Verified Standards

Companies working alongside STTG adhere to stringent verification processes aligned with international standards such as the Verified Carbon Standard (VCS) and the Climate, Community & Biodiversity Standards (CCBS). These processes validate the authenticity of carbon credits generated through conservation initiatives. This approach ensures that each credit represents a genuine carbon offset while contributing to biodiversity preservation and enhancing local community well-being. Independent reports from reputable organizations such as KPMG and CSIS highlight the exceptional quality and global market value of these credits.

Financial Implications and Global Trends for Carbon Credit Markets

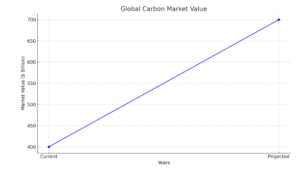

Investing in high-quality carbon credits offers a unique opportunity for financial gains aligned with global carbon reduction goals. The carbon credit market, valued at over $400 billion and expected to grow significantly, attracts investors looking for sustainable investment opportunities. The regulatory landscape, as detailed by IOSCO’s report on voluntary carbon markets, plays a significant role in shaping these investments, with stringent standards enhancing the market’s credibility and attracting more stakeholders.

Challenges and Future Outlook

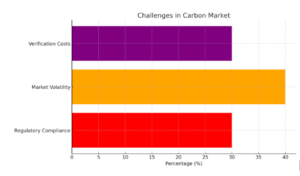

Navigating the carbon market’s regulatory environment requires agility and foresight, as global policies and standards evolve rapidly. STTG’s proactive approach ensures compliance and maximizes the efficacy of their carbon credits. Looking ahead, STTG plans to scale up its conservation projects and explore new opportunities for sustainable land manag

Economic Impacts and Investment Opportunities

STTG’s economic framework is designed to attract investors seeking opportunities that deliver both financial returns and positive environmental outcomes. Investments in carbon credits offer a unique proposition by aligning financial growth with global carbon reduction goals. STTG’s investment model includes funding land acquisitions and generating carbon credits from these conservation areas.

These carbon credits, validated through recognized international standards, create a sustainable revenue stream. As carbon credits gain value in global markets due to increased demand for environmental responsibility, investors benefit from competitive returns while supporting climate-positive initiatives. This approach ensures long-term financial sustainability while fostering environmental conservation and community development.

Challenges and Regulatory Considerations

Navigating the carbon market’s regulatory environment is complex, given the varying standards and requirements across different jurisdictions. STTG has to continuously adapt to these changes, ensuring compliance while also maximizing the efficacy of their carbon credits. The evolving nature of global climate policies means that STTG must remain agile, anticipating and responding to new developments in carbon pricing and international climate agreements.

Long-term Vision and Sustainability Goals

Looking ahead, STTG is focused on expanding its role in global carbon markets by scaling up its successful models of forest conservation and sustainable land management. The long-term vision includes not only the expansion of current projects but also the exploration of new opportunities in other regions vulnerable to deforestation. By doing so, STTG aims to further its impact on global carbon emissions, while also supporting the preservation of biodiversity and the sustenance of local communities.

STTG demonstrates how regulatory frameworks can be effectively navigated to achieve both environmental and financial success. Through partnerships with various strategic alliances, STTG sets benchmarks in the carbon credit market, driving the broader adoption of carbon credits as a powerful tool in combating climate change.

These efforts align seamlessly with global sustainability goals, ensuring that environmental initiatives are not just promises but result in measurable, impactful outcomes. By investing with STTG, you join a movement where environmental stewardship and financial growth work hand in hand to create a sustainable, thriving future.